Throwing away the wheat and keeping the chaff.

Our previous discussions on timing revolved around changing exposures to all factors. This includes both price based factors (volatility, momentum) and fundamental factors (quality, value.) While my personal preference, given its ease of implementation and low turnover, is factor rotation, multi-factor investing is a legitimate contender as well.

However, in the absence of liquid ETFs and index funds that track these individual factors, implementing such strategies is non-trivial and comes with cost-challenges and tracking errors. At the same time, being exposed to a single factor is a test of endurance – very few investors have the patience and time-horizon to stick through the ebb and flow single-factor portfolios. We touched upon this on our post of Magic Formula, a deep-value investment strategy.

So, is there a simple way to time a single factor?

Today, we pick the Value factor and run through some intuitive approaches to time it.

The Market Price-to-Book

Value factor strategies use relative value rankings to create portfolios. The problem with relative value is that if the market as a whole is expensive, which it usually is at the peak of bull markets, then the portfolio ends up with junk that can’t find a bid even during a bullish regime. Consequently, when the market inevitably turns, these portfolios suffer steep drawdowns.

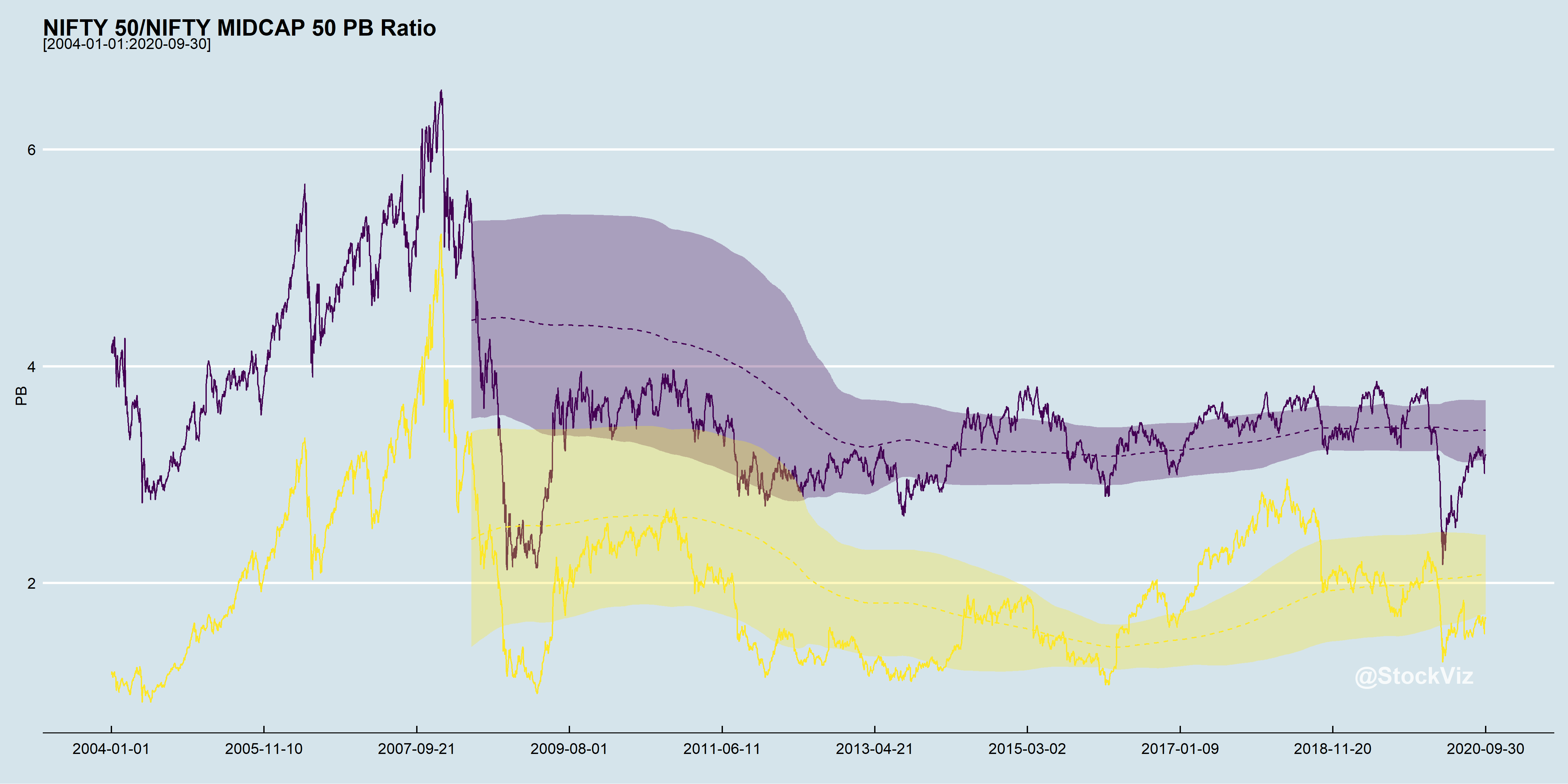

What if, we were long the value factor only when the market is between a one-standard-deviation of historical valuations?

Timing the Value Factor

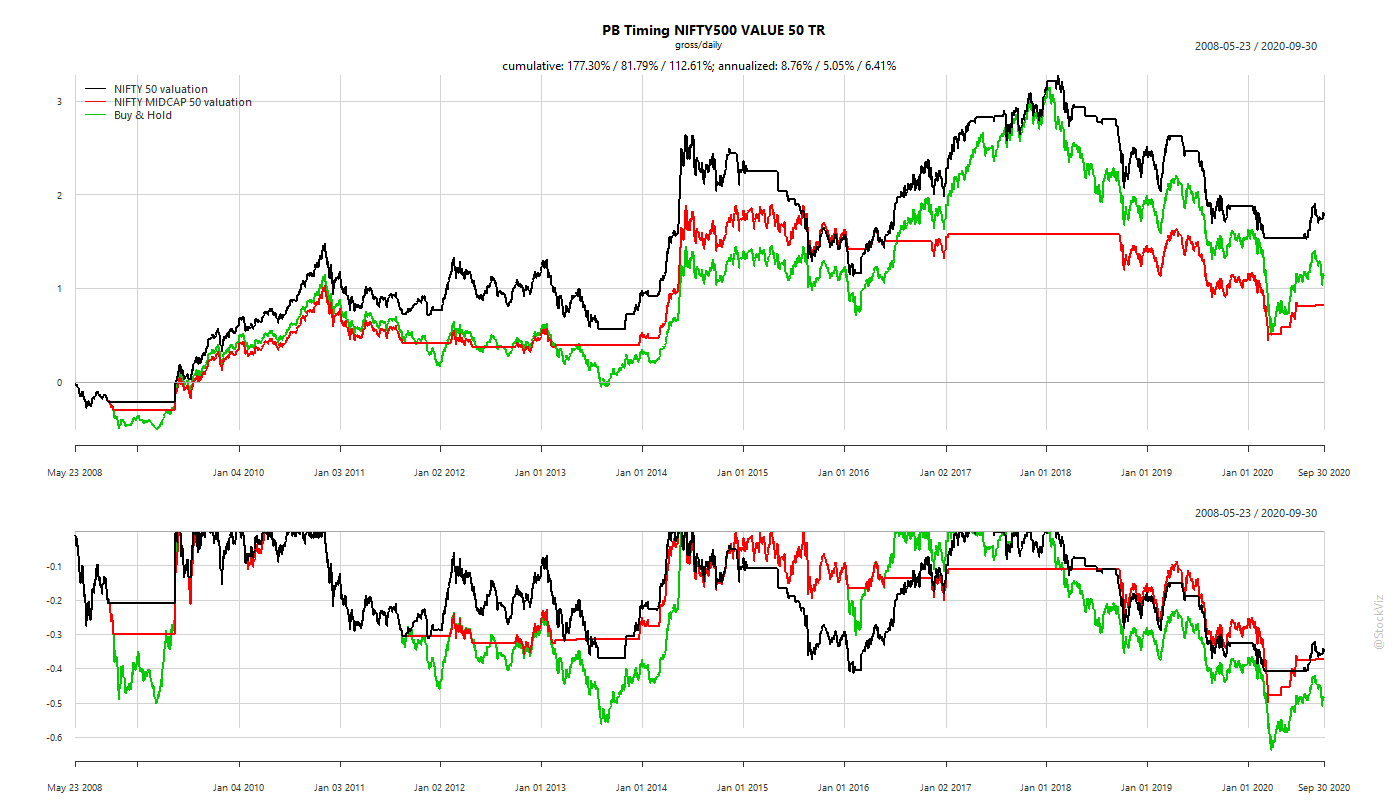

We go long the NIFTY500 VALUE 50 TR index if NIFTY 50 (alternately, MIDCAP 50) price-to-book is between bands. Stay in cash otherwise.

Using the NIFTY 50 PB ratio holds promise with annualized returns of the strategy clocking in at 8.75% vs. buy-and-hold’s 6.41% and shallower drawdowns to boot. However, we expect costs and taxes to pare away most of those excess returns.

Also, the problem with strategies that “go to cash” is that it brings with it cash management problems. Investors find other uses for the cash in their account and it is quite possible that when the time comes to buy, the cash would be blocked for use some where else.

Using Market PB to Manage Exposures

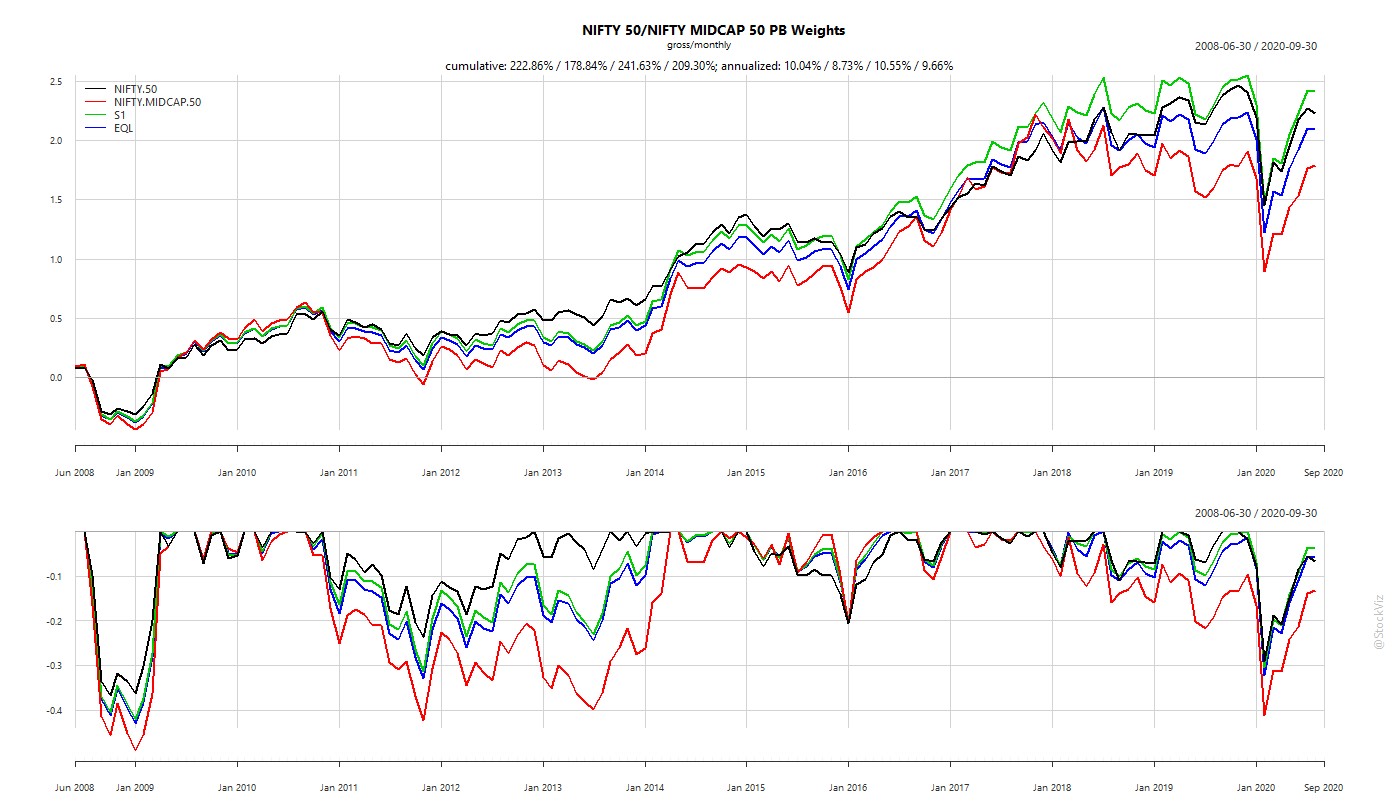

An alternative to timing the Value factor is to change the relative exposures of large and mid-cap allocations based on the market’s price-to-book. Here, you are always invested in the market but over-weight the cheaper index.

Suppose, the relative ratio, R = MIDCAP PB/NIFTY PB

Then, at the end of every month, re-weight the portfolio so that,

S1 = R * NIFTY + (1-R) * MIDCAP

On a monthly rebalance frequency, S1 clocks in a slightly higher annualized return compared to NIFTY 50 TR. However, it remains a disappointment after you consider transaction costs and taxes.

Combining Value and Momentum

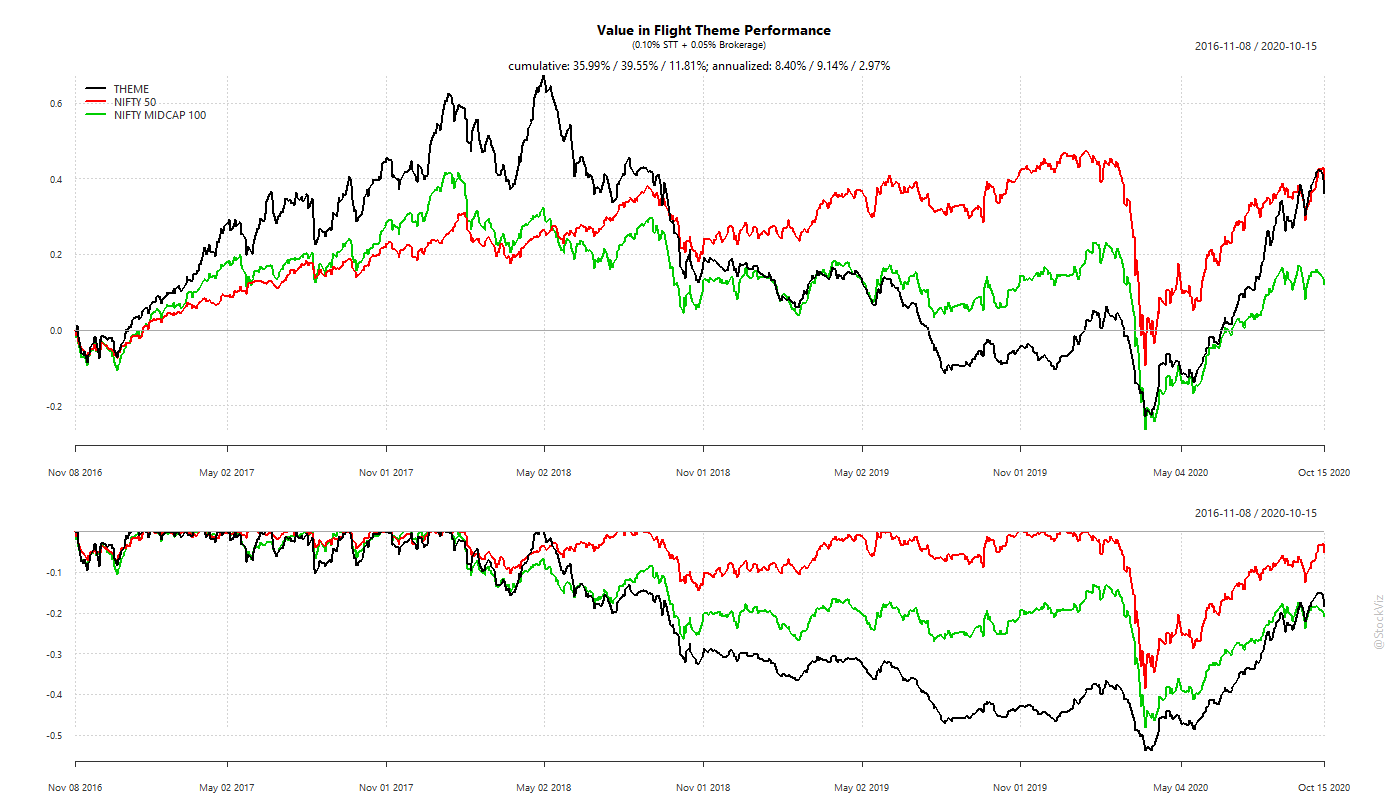

What if, we first applied a relative-momentum cut-off before ranking stocks based on value? And managed risk by having a 10% trailing stop-loss? Would that overcome the adverse selection problem? After all, you are applying a value filter on stocks that are already moving higher.

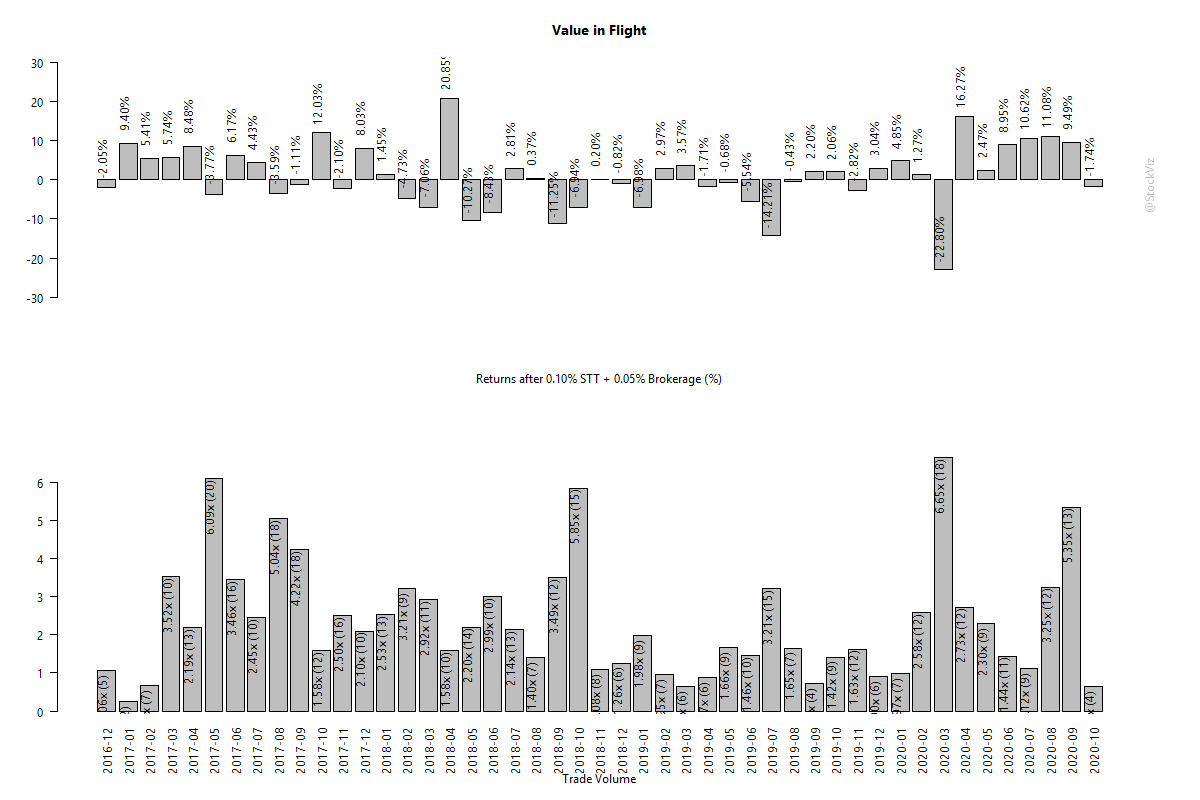

We setup such a portfolio, Value in Flight, to track such a strategy.

What leaps out of this performance chart is that momentum over-powers value both on the upside and on the downside. During a bull market, investors likely fool themselves into believing that they have invested in a “value” portfolio while it is momentum driving returns.

Besides, using momentum with a stop-loss increases churn.

The bottom half of the chart shows how churn increases with market volatility.

It appears that combining value and momentum incurs all the costs of a momentum strategy and all the downsides of a relative-value strategy.

Conclusion

We tested three intuitive approaches to avoid adverse selection in relative value strategies. The first one used market valuations to time the value factor while the second used it to change relative weights within a portfolio. The third tried to combine momentum and value. None of these approaches make sense after considering transaction costs and taxes.

While the number of blind alleys in investment strategy research is potentially unlimited, we believe that the last word on this subject is yet to be written.

Comments are closed, but trackbacks and pingbacks are open.